NEWS

High mountain

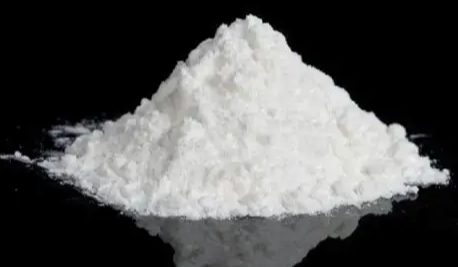

PVC Market Rises Then Falls Amid Policy and Fundamental Factors

Time: 2026-01-21

In January, China's PVC market was influenced by both policy developments and industry fundamentals, resulting in a volatile price trajectory. Early in the month, expectations of regional electricity cost increases and shifts in futures trading drove spot prices upward. The average price of calcium carbide-based PVC rose to RMB 4,381 per ton, a 2.89% increase from early January, while ethylene-based PVC reached RMB 4,844 per ton, up 3.53%. Trading activity improved temporarily as suppliers adjusted offers and distributors increased inventory operations.

However, as policy effects were gradually absorbed, market focus returned to actual demand and cost pressures. By mid-January, export policy adjustments stimulated some inquiry for ethylene-based PVC, but calcium carbide-based PVC saw limited export orders. Domestically, downstream product manufacturers maintained low operating rates and cautious purchasing, leading to weaker spot transactions. Towards late January, futures market corrections further weighed on spot prices, with sentiment turning cautious.

From a cost perspective, raw material costs for calcium carbide-based PVC edged up slightly, but price increases were insufficient to fully offset cost pressures, leaving the segment in a loss position. For ethylene-based PVC, ethylene prices weakened, reducing cost support and keeping profit margins constrained. Overall, the PVC industry continues to face challenges from soft demand and elevated costs.

Looking ahead, supply remains ample in the short term, while demand from construction and other terminal sectors is expected to slow further as seasonal factors intensify. Calcium carbide-based PVC prices may decline by RMB 20-30 per ton in late January, while ethylene-based PVC could stabilize due to steady plant operations and pre-sold orders. In the longer term, with the Chinese New Year approaching, logistics slowdowns and reduced construction activity will likely weaken demand further, potentially driving prices down by RMB 30-50 per ton in February.

Mobile version

HOME | ABOUT US | PRODUCTS | NEWS | HONORS | FACTORY | CONTACT | 中文版

Copyright(C)2025, Wuxi High Mountain Hi-tech Development Co., Ltd. All Rights Reserved. Supported by Sunsirs ChemNet Toocle Copyright Notice 备案序号:苏ICP备2025195488号