NEWS

High mountain

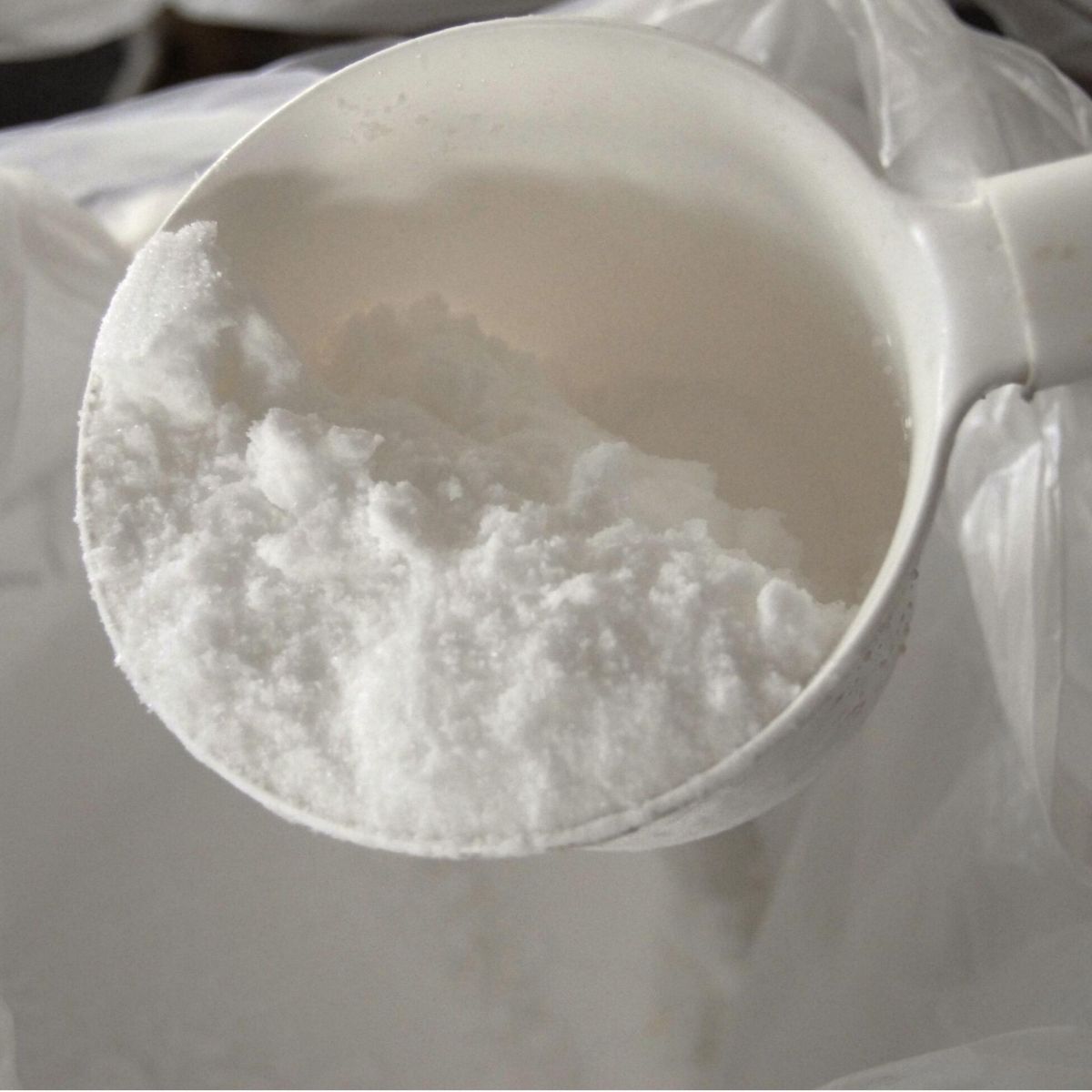

Chloroacetic Acid Market Rises in January as Cost Pressure Pushes Producers to Lift Prices

Time: 2026-01-28

Keywords: chloroacetic acid market, chloroacetic acid price, CAA market trend, chloroacetic acid forecast

In January 2026, the chloroacetic acid market in China recorded a moderate price increase supported by strong cost-side factors. Although downstream purchasing remained cautious and demand growth was limited, producers actively raised quotations to offset rising raw material costs from acetic acid and liquid chlorine.

As of January 27, the average monthly price of chloroacetic acid reached RMB 3,161.30 per ton, up 1.81% compared with the previous month.

At the beginning of the month, major producers in Henan resumed normal production after environmental-related output restrictions ended. Operating rates increased, leading to higher supply and renewed quotations at slightly elevated levels influenced by surrounding high-price regions. Meanwhile, new production units in Hebei and Jiangsu began operation but have not yet reached full capacity, resulting in limited impact on overall market supply. Other regions maintained relatively stable market conditions with balanced but slow-moving demand and supply.

Toward the end of January, prices of acetic acid and liquid chlorine remained firm at high levels, significantly increasing production costs. To maintain reasonable margins, most domestic manufacturers raised their quotations simultaneously, which pushed the overall market upward.

Mainstream transaction prices for flake chloroacetic acid currently range between 3250–3350 RMB/ton in Shandong, 3150–3250 RMB/ton in Henan, 3050–3150 RMB/ton in Shanxi, and 3300–3400 RMB/ton in Hubei.

From a cost perspective, acetic acid prices are expected to fluctuate and potentially weaken in the future, while liquid chlorine prices may also face correction. The cost-driven momentum supporting higher chloroacetic acid prices is likely to diminish gradually.

From a supply perspective, new capacities in Jiangsu are being gradually implemented, and additional production plans are expected in Hebei. Once these new capacities are fully operational, supply pressure in the market will increase significantly.

From a demand perspective, downstream industries such as agrochemicals and dye intermediates continue to show weak demand growth, mainly purchasing based on essential needs rather than expansion.

Before new capacities are fully realized, the chloroacetic acid market is expected to maintain a high-level consolidation trend. However, as additional supply from Jiangsu and Hebei enters the market, the supply-demand balance may shift toward a looser situation. As a result, the price center is likely to face downward pressure, with a potential decline of around RMB 100 per ton.

Wuxi High Mountain Hi-tech Development Co., Ltd. will continue to monitor the chloroacetic acid market trend and provide timely market insights and stable supply support to global customers.

Mobile version

HOME | ABOUT US | PRODUCTS | NEWS | HONORS | FACTORY | CONTACT | 中文版

Copyright(C)2025, Wuxi High Mountain Hi-tech Development Co., Ltd. All Rights Reserved. Supported by Sunsirs ChemNet Toocle Copyright Notice 备案序号:苏ICP备2025195488号